Our Clark Wealth Partners Ideas

Table of ContentsHow Clark Wealth Partners can Save You Time, Stress, and Money.The Buzz on Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Not known Incorrect Statements About Clark Wealth Partners The Of Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersAbout Clark Wealth PartnersClark Wealth Partners Can Be Fun For Anyone

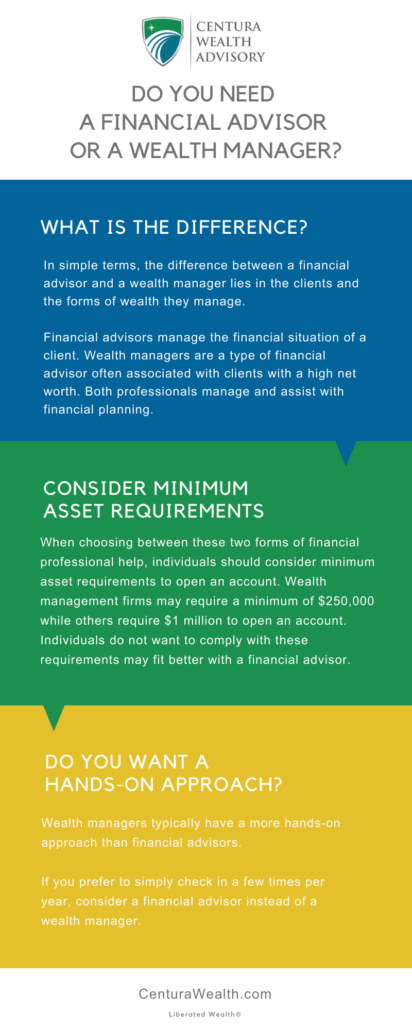

Usual reasons to think about a financial advisor are: If your economic circumstance has actually become extra complex, or you lack confidence in your money-managing abilities. Saving or navigating significant life occasions like marriage, divorce, youngsters, inheritance, or job adjustment that might significantly affect your monetary situation. Navigating the transition from saving for retired life to maintaining wide range throughout retired life and just how to create a strong retired life earnings strategy.New modern technology has brought about even more detailed automated monetary devices, like robo-advisors. It's up to you to investigate and establish the right fit - https://anyflip.com/homepage/btjzk#About. Eventually, a good monetary advisor should be as mindful of your investments as they are with their very own, avoiding too much fees, saving money on tax obligations, and being as clear as possible about your gains and losses

Clark Wealth Partners - Truths

Earning a commission on product recommendations does not necessarily indicate your fee-based advisor antagonizes your ideal rate of interests. They might be much more likely to recommend items and solutions on which they earn a commission, which might or might not be in your ideal interest. A fiduciary is legally bound to place their client's passions.

This common permits them to make recommendations for investments and services as long as they match their client's objectives, threat tolerance, and financial scenario. On the various other hand, fiduciary consultants are legally bound to act in their client's best interest instead than their own.

The Buzz on Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving right into intricate financial subjects, dropping light on lesser-known financial investment opportunities, and revealing methods visitors can function the system to their benefit. As a personal financing expert in her 20s, Tessa is acutely familiar with the effects time and uncertainty have on your investment choices.

It was a targeted advertisement, and it worked. Find out more Review less.

Clark Wealth Partners Fundamentals Explained

There's no solitary route to ending up being one, with some individuals beginning in banking or insurance, while others begin in bookkeeping. A four-year degree gives a strong foundation for jobs in financial investments, budgeting, and customer solutions.

Clark Wealth Partners for Dummies

Common instances include the FINRA Series 7 and Series 65 exams for safety and securities, or a state-issued insurance certificate for marketing life or medical insurance. While credentials might not be legitimately needed for all intending functions, employers and customers frequently watch them as a standard of professionalism. We consider optional credentials in the next area.

Many economic planners have 1-3 years of experience and knowledge with financial items, compliance criteria, and straight customer interaction. A solid educational history is essential, yet experience demonstrates the capacity to use theory in real-world setups. Some programs integrate both, allowing you to complete coursework while earning monitored hours with teaching fellowships and practicums.

Things about Clark Wealth Partners

Lots of go into the area after working in financial, accounting, or insurance coverage, and the shift needs persistence, networking, and frequently innovative qualifications. Early years can bring lengthy hours, pressure to develop a client base, and the requirement to continually show your knowledge. Still, the career offers solid long-lasting capacity. Financial coordinators take pleasure in the opportunity to work carefully with clients, guide essential life decisions, and frequently achieve flexibility in routines or self-employment.

Riches managers can increase their earnings with commissions, possession costs, and performance incentives. Financial managers manage a group of economic planners and advisers, setting department technique, taking care of conformity, budgeting, and guiding internal operations. They invested much less time on the client-facing side of the sector. Nearly all monetary supervisors hold a bachelor's level, and lots of have an MBA or similar academic degree.

Top Guidelines Of Clark Wealth Partners

Optional certifications, such as the CFP, typically call for extra coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, personal economic experts gain a typical yearly yearly income of $102,140, with top earners making over $239,000.

In other provinces, there are laws that require them to satisfy certain demands to make use of the economic expert or financial organizer titles (financial advisors illinois). What sets some monetary experts in addition to others are education and learning, training, experience and qualifications. There are lots of classifications for economic advisors. For financial coordinators, there are 3 usual designations: Qualified, Personal and Registered Financial Coordinator.

Everything about Clark Wealth Partners

Where to discover a monetary expert will depend on the kind of recommendations you require. These establishments have team that might assist you understand and acquire try this web-site particular types of investments.